Severing ties with a financial institution? Closing a bank account might seem simple, but taking the right steps, particularly crafting a formal account closure request, ensures a smooth and hassle-free process. This comprehensive guide navigates the nuances of closing bank accounts, providing you with the knowledge and tools to confidently manage this financial task.

Why is a formal request to close a bank account so important? Imagine a scenario where you verbally request closure, but residual funds remain or automated transactions continue, potentially leading to overdraft fees and headaches. A well-written account termination letter provides clear instructions, documented proof of your request, and minimizes the risk of future complications.

While the precise origin of the formal bank account closure letter isn't readily documented, it evolved alongside banking practices as a standardized way to communicate clear intentions. Its importance lies in protecting both the account holder and the bank, providing a documented record of the closure request and preventing disputes.

One of the main issues surrounding account termination letters is the lack of awareness regarding their necessity and correct format. Many individuals assume verbal communication suffices, leading to potential misunderstandings and delays. This guide aims to clarify these ambiguities, empowering you to close your account effectively.

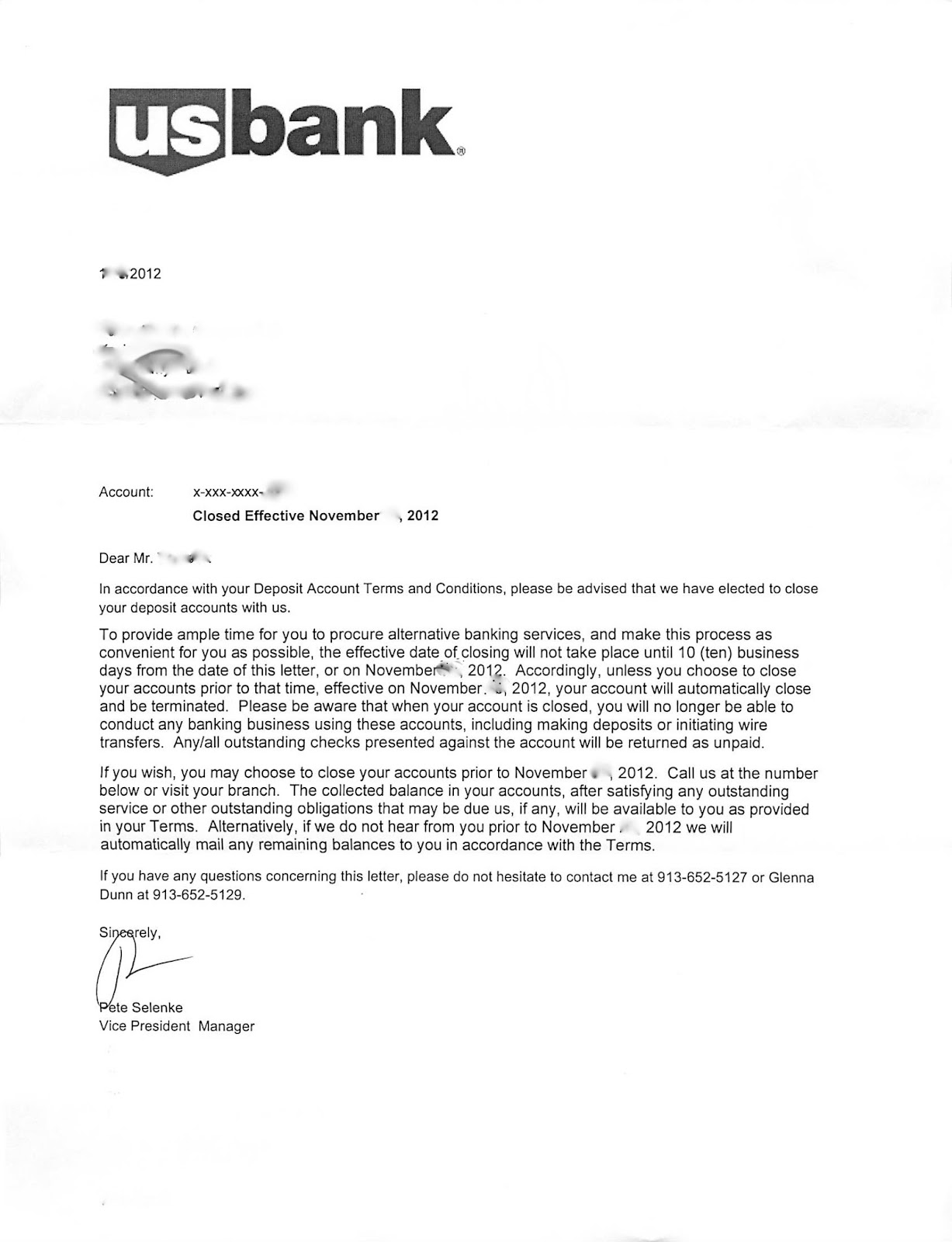

A bank account closure letter, essentially, is a formal written notification to your bank requesting the termination of a specific account. This letter should include essential information such as your account number, the date of closure request, instructions for disbursing remaining funds, and your forwarding address for sending the final statement. It acts as a binding instruction, leaving no room for misinterpretation.

While bank closure procedures can vary, sending a formal notification remains a crucial step. This practice ensures your request is documented, minimizing potential future issues like unauthorized transactions or difficulty accessing your funds after closure.

One benefit of a formal closure letter is its clarity. A written document leaves no room for misinterpretation. A second advantage is its role as proof. You have tangible evidence of your request, protecting you from potential disputes. Lastly, a formal closure process encourages organized financial practices, ensuring a smooth transition when switching banks or consolidating accounts.

Crafting an effective bank account closure letter involves a few simple steps. First, clearly state your intention to close the account, mentioning the account number and type. Then, specify your desired closure date and provide instructions for transferring any remaining balance. Include your forwarding address for receiving your final statement. Finally, proofread carefully before sending.

Before closing your account, ensure all automatic payments and deposits are rerouted. Verify the account balance and ensure any outstanding checks have cleared. Finally, confirm the receipt of your account closure confirmation and final statement from the bank.

A step-by-step guide: 1. Gather account details. 2. Draft the letter. 3. Sign and send. 4. Verify closure and final statement.

Consult your bank's website for specific guidelines and templates. Many banks provide online resources to simplify the process.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Clear communication | Requires written communication |

| Documented proof of request | May take slightly longer than verbal request (if bank allows) |

| Reduces potential disputes |

Best practices include using a professional tone, being concise, keeping a copy of the letter, following up if you don't receive confirmation, and reviewing your final statement carefully.

Examples of real scenarios where closure letters are critical include closing joint accounts, closing accounts of deceased relatives, and closing accounts when moving abroad.

Challenges like lost account numbers can be solved by contacting the bank. Unresolved disputes should be addressed before closure.

FAQs include questions about closing fees, the time it takes to close an account, and what happens to automatic payments.

A helpful tip is to request a written confirmation of account closure. This provides tangible proof of the completed process.

Closing a bank account properly, specifically with a formal termination letter, is more than just a procedural step; it's a critical aspect of responsible financial management. It ensures a clean break, minimizes the risk of future complications, and provides peace of mind. Taking the time to draft a clear, concise letter and following the recommended steps outlined in this guide protects your financial interests and promotes a smooth transition. Remember to verify all details, maintain records of your communication, and follow up with your bank if necessary. By taking these proactive measures, you can confidently manage your finances and ensure a hassle-free account closure experience. Don't just close your account – close it the right way.

Henna for grey hair a natural solution

Precision power optimizing machinery with shaft alignment tools in uae

Finding comfort and closure exploring recent obituaries