Ever wonder how federal employee salaries are determined? It's a complex system involving the General Schedule (GS) pay scale, but what about those "special salary rates" you sometimes hear about? These adjustments can significantly impact an employee's take-home pay, and understanding them is crucial for both current and prospective federal employees. This article dives deep into the world of GS pay, focusing on these often-confusing special rates.

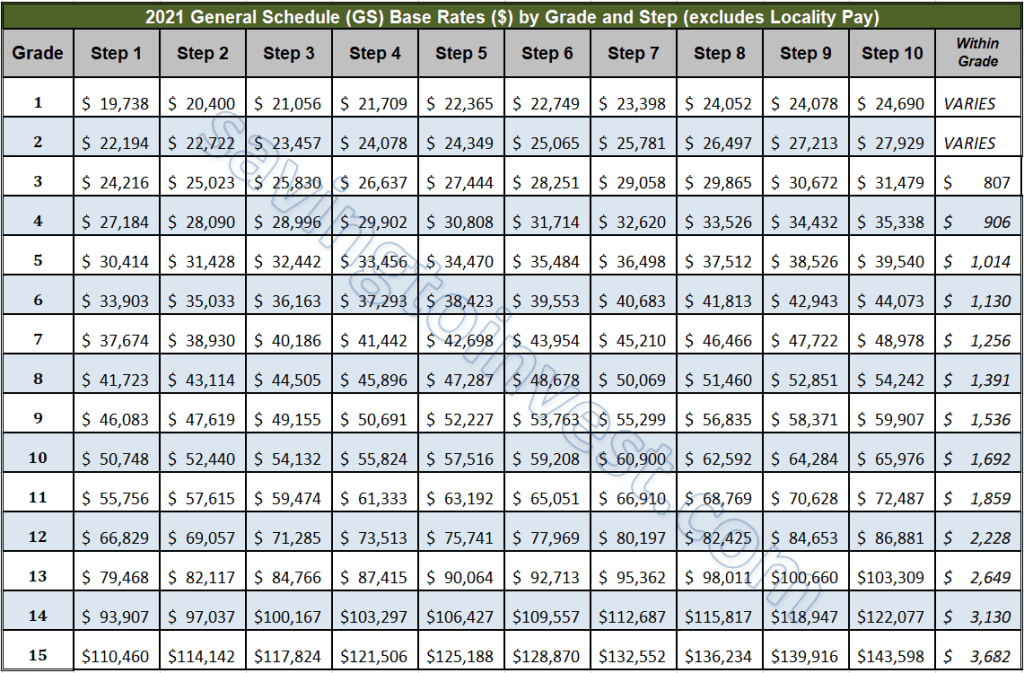

The GS pay scale is the backbone of the federal compensation system, providing a structured framework for determining salaries based on grade level and experience. However, recognizing that certain occupations face unique recruitment or retention challenges, the government implemented special salary rates. These rates deviate from the standard GS scale, offering higher compensation to attract and retain highly skilled individuals in specific fields.

Historically, the GS system aimed to standardize federal pay, but rigid adherence to the standard scale often proved inadequate. Factors like geographic location and highly specialized skills weren't always reflected. Special salary rates emerged as a solution to these limitations, providing a mechanism for greater flexibility in adjusting compensation. Their importance lies in ensuring that the government can compete with the private sector for talent in critical areas.

One of the primary issues associated with special salary rates is the potential for discrepancies and perceived unfairness. While designed to address specific needs, these adjustments can sometimes lead to situations where employees in similar roles, but different locations or agencies, receive varying compensation. Transparency and clear communication about the rationale behind special rate implementation are key to addressing such concerns.

A "special salary rate" is an authorized deviation from the standard GS pay scale for a specific occupation or geographic location. For example, certain high-demand IT positions might receive a special rate to compete with private sector salaries. Similarly, "locality pay adjustments" are a type of special rate that accounts for higher living costs in certain areas. Let's say a GS-9 employee in San Francisco receives a locality pay adjustment, boosting their salary to reflect the higher cost of living compared to a GS-9 employee in a lower-cost area.

Understanding your GS pay, including any applicable special rates, is crucial for managing your finances and career progression. This requires access to reliable resources. The Office of Personnel Management (OPM) website provides detailed information on the GS pay scale and special salary rates. Additionally, your agency's human resources department can offer specific guidance on your individual pay situation.

Advantages and Disadvantages of Special Salary Rates

| Advantages | Disadvantages |

|---|---|

| Enhanced recruitment and retention of critical talent | Potential for pay disparities and perceived inequity |

| Improved competitiveness with the private sector | Complexity in administration and understanding |

Frequently Asked Questions:

1. What is a GS Special Salary Rate? - A higher pay rate authorized for specific jobs.

2. How are Special Salary Rates determined? - By OPM based on market conditions and agency needs.

3. How do I find out if my position qualifies for a Special Salary Rate? - Check OPM's website or contact your HR department.

4. Are Special Salary Rates permanent? - They can be adjusted or discontinued based on changing needs.

5. Do all federal employees receive locality pay? - No, it depends on the geographic location.

6. How does locality pay affect my salary? - It increases base pay based on higher living costs in specific areas.

7. Can special salary rates be combined with other pay adjustments? - Yes, in some cases.

8. How often are special salary rates reviewed? - OPM periodically reviews and adjusts these rates.

Navigating the intricacies of the GS pay system and special salary rates can feel daunting. Staying informed, utilizing available resources, and advocating for your own understanding are key to ensuring fair compensation.

In conclusion, understanding the GS pay scale, especially the nuances of special salary rates and locality pay, is essential for anyone working in or considering a career with the federal government. These adjustments play a vital role in attracting and retaining talent, ensuring competitive compensation in a dynamic job market. By staying informed about these components of federal pay, employees can better manage their financial well-being and navigate their career progression. Whether you're a current federal employee or exploring future opportunities, investing time in understanding your GS pay and any applicable special rates is a worthwhile endeavor that can significantly impact your overall financial health and career satisfaction.

The fiery skull exploring the art of depicting flaming craniums

Decoding espn nfl expert picks your gridiron guide

The silent eloquence of cart wheels a guide to precise measurement