In today's fast-paced world, moving money quickly and securely is paramount. One popular method is the wire transfer, a convenient electronic funds transfer system that allows you to send money directly to a recipient's bank account. This article will delve into the specifics of sending a wire transfer to a Wells Fargo account, providing you with a comprehensive guide to navigate the process seamlessly.

Imagine needing to send money to a family member across the country for an emergency or finalizing a large purchase like a car. Wire transfers offer a swift and reliable solution, eliminating the delays associated with traditional checks or money orders. Understanding the intricacies of wiring money to a Wells Fargo account can empower you to manage your finances effectively.

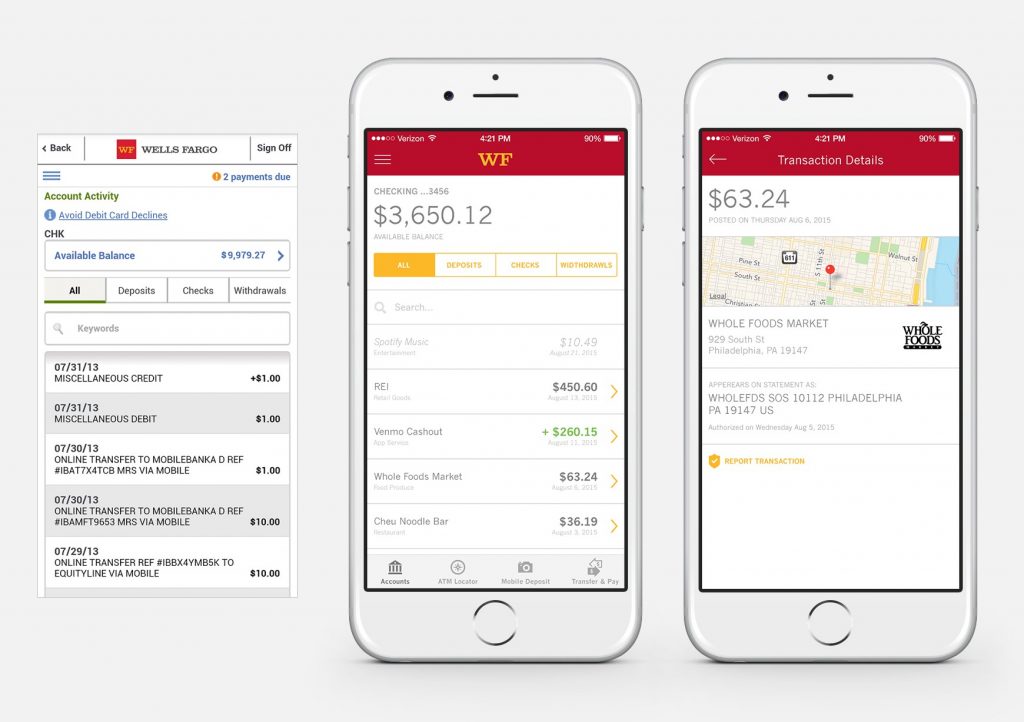

Sending money via wire transfer to a Wells Fargo account involves a few key steps. Typically, you'll need the recipient's Wells Fargo account number, their name as it appears on the account, and the bank's routing number. There are two main ways to initiate a wire transfer: domestically, within the United States, and internationally. For domestic transfers, the Wells Fargo routing number is usually sufficient. For international transfers, a SWIFT code might be required, which identifies Wells Fargo's specific branch for international transactions.

The history of wire transfers is intertwined with the development of telecommunications. The earliest forms of electronic funds transfers emerged in the late 19th century with the invention of the telegraph. Over time, these systems evolved to become more secure and efficient, paving the way for modern wire transfers as we know them. Wells Fargo, a longstanding financial institution, has been at the forefront of adapting to these technological advancements, offering its customers streamlined wire transfer services.

The importance of wire transfers lies in their speed and security. They are especially useful for large transactions where a paper check might be impractical or where speed is essential. For instance, real estate closings often rely on wire transfers to ensure the timely transfer of funds. Sending a domestic wire transfer to a Wells Fargo account typically takes one business day, while international transfers can take a bit longer due to additional processing requirements.

One key benefit of using wire transfers is the speed of the transaction. Funds are typically available to the recipient within one to three business days, significantly faster than traditional methods. Another advantage is the security afforded by the electronic nature of the transfer. With proper authentication and security protocols, the risk of fraud or theft is minimized. Lastly, the convenience of initiating a wire transfer either online or in person at a branch adds to its appeal.

To initiate a wire transfer to a Wells Fargo account, you'll need to gather some essential information. This includes the recipient's full name and account number, as well as the Wells Fargo routing number. For international transfers, you'll also need the SWIFT code. You can typically initiate the transfer through your bank's online platform, mobile app, or by visiting a branch in person.

Advantages and Disadvantages of Wire Transfers to Wells Fargo

| Advantages | Disadvantages |

|---|---|

| Speed and efficiency | Cost (typically higher than other transfer methods) |

| Security and reliability | Irreversibility (difficult to reverse a transfer once sent) |

| Large transaction capability | Potential for fraud if proper security protocols aren't followed |

Best practices for wire transfers include double-checking all recipient information, using strong passwords and two-factor authentication for online banking, and being wary of suspicious emails or phone calls requesting banking details. Be sure to review the terms and conditions of your bank's wire transfer service, paying attention to fees and transfer limits.

Frequently Asked Questions: What is a routing number? How long does a domestic wire transfer take? What is a SWIFT code? How do I track my wire transfer? Can I cancel a wire transfer? What are the fees for wire transfers? How do I report a fraudulent wire transfer? What security measures should I take when sending a wire transfer?

Tips and tricks: Always verify the recipient's information. Keep records of your wire transfer confirmations. Be aware of potential scams. Use strong passwords for your online banking.

In conclusion, wiring money to a Wells Fargo account provides a swift, secure, and convenient method for transferring funds. Understanding the process, associated fees, and security measures empowers you to manage your finances effectively. By utilizing the information provided in this guide, you can confidently navigate the world of wire transfers and ensure smooth and secure transactions. Whether you're sending money to family, making a large purchase, or managing your business finances, wire transfers offer a reliable solution for your financial needs. Embrace the speed and convenience of modern banking and make the most of this efficient transfer method.

Chevy 4 cylinder turbo uncovering the hype reviews insights and more

Engaging activities for third graders

Dreamy illustrations exploring the world of layla genshin impact fanart