Sending money across borders has become increasingly common in our globalized world, whether it's supporting family members, paying for international services, or conducting business transactions. For many, Western Union stands out as a familiar and accessible option. But before you commit to a transfer, understanding Western Union's send money abroad rates is crucial for ensuring you're getting the most value for your money.

Navigating the world of international money transfers can feel complex, with various fees, exchange rates, and transfer speeds to consider. This article aims to demystify Western Union's send money abroad rates, providing you with the knowledge to make informed decisions. We'll explore the factors that influence these rates, offering insights into how they are calculated and how to potentially minimize costs.

Western Union, a household name in the money transfer industry, offers a vast network spanning over 200 countries and territories. This extensive reach makes it a convenient choice for many. However, convenience often comes at a price. It's essential to compare Western Union's rates with other money transfer providers to ensure you're not paying more than necessary.

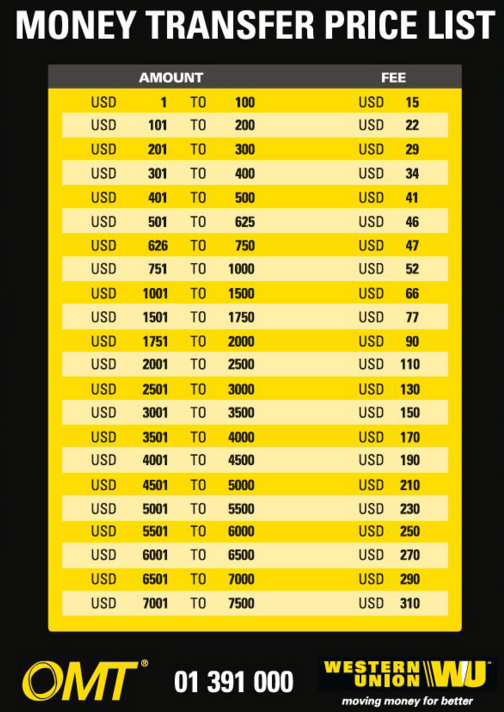

The cost of sending money abroad with Western Union depends on a number of variables. These include the destination country, the amount being sent, the payment method (e.g., bank transfer, cash pickup), and the currency exchange rate. Understanding how these factors interact can help you strategize for more cost-effective transfers. For instance, sending larger amounts may result in a lower fee per dollar transferred.

One of the key aspects to consider is the exchange rate offered by Western Union. This rate is often different from the mid-market rate, which is the midpoint between the buy and sell prices of two currencies. The difference between the Western Union rate and the mid-market rate represents a markup, which is part of how Western Union generates revenue. Being aware of this difference can help you gauge the overall cost of your transfer.

Western Union was founded in 1851 as the New York and Mississippi Valley Printing Telegraph Company. It quickly evolved into a leader in telecommunication and subsequently expanded into financial services, including money transfers. Historically, Western Union's services have been crucial for facilitating cross-border payments, particularly before the rise of digital alternatives.

Several factors affect Western Union send money abroad rates. These can include currency volatility, regulatory costs in different countries, and operational expenses. Major issues related to international money transfer rates often revolve around transparency and competitiveness. Consumers are increasingly seeking clearer information about the total cost of their transactions, prompting a demand for greater transparency from providers like Western Union.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Wide network and accessibility | Potentially higher fees compared to other services |

| Cash pickup option in many locations | Exchange rate markups can add to the cost |

| Established reputation and brand recognition | Transfer speeds can vary depending on the method |

Frequently Asked Questions about Western Union Send Money Abroad Rates:

1. How can I find the current Western Union exchange rate? - Check the Western Union website or app.

2. Are there fees in addition to the exchange rate? - Yes, there can be transfer fees.

3. How long does a Western Union transfer take? - It can vary, from minutes to days.

4. Can I cancel a Western Union transfer? - Possibly, depending on the status of the transfer.

5. What payment methods can I use with Western Union? - Options include bank transfers, debit cards, and cash.

6. How do I track my Western Union transfer? - Use the tracking number provided.

7. What is the maximum amount I can send with Western Union? - Limits vary depending on regulations and your transaction history.

8. Is it safe to send money through Western Union? - Western Union has security measures in place, but it's essential to follow their guidelines.

Tips for Sending Money with Western Union:

Compare rates with other providers before sending. Check for promotions or discounts. Consider sending larger amounts if possible to potentially reduce the fee per dollar. Be aware of the exchange rate markup.

In conclusion, understanding Western Union's send money abroad rates is essential for anyone looking to transfer funds internationally. By considering the various factors influencing these rates, comparing options, and staying informed about potential fees and exchange rate markups, you can make more informed decisions and ensure you're getting the best value for your money. While Western Union offers convenience and a wide network, comparing rates with competitors and using available tools to calculate total costs is crucial for making smart financial choices. Take the time to research and compare to find the best option for your international money transfer needs.

Navigating malaysian police cooperatives my ahli koperasi polis

Uncovering betty smith in jacksonville fl

The magic of ac to dc conversion